Blog

Federal Tax Lien Scam

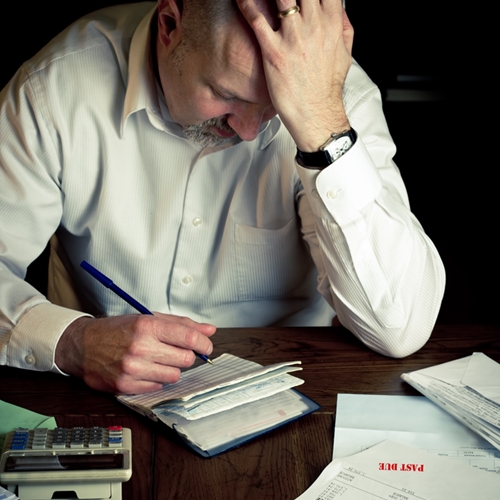

The latest scam to target business owners claims that a warrant has been issued to a taxpayer because of unpaid tax obligations. As with previous scam efforts, the letter goes on to warn that the warrant could result in arrests or other criminal action if the taxpayer doesn’t pay immediately.

In some cases, the fake IRS letters have included facts about real tax debts. This is scary for taxpayers because it feels legitimate. Please keep in mind that some tax-related information, like liens that have been filed against taxpayers, may be available to the public. Do NOT assume a notice is real simply because some facts are included in the correspondence.

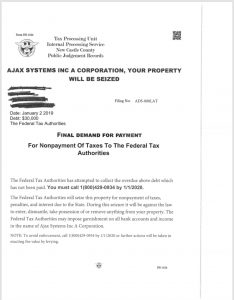

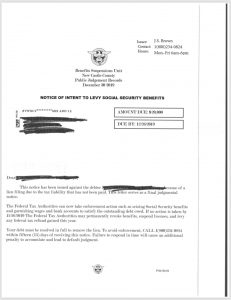

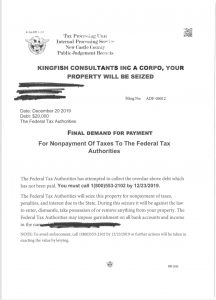

Three examples of these FAKE letters are shown below.

Here are some details about the property lien scam that will help taxpayers recognize it:

- This scheme involves a letter threatening an IRS lien or levy.

- The scammer mails the letter to a taxpayer.

- The lien or levy is based on bogus overdue taxes owed to a non-existent agency.

- The non-existent agencies might have a legitimate-sounding name like the “Bureau of Tax Enforcement.” There is no such agency.

- This scam may also reference the IRS to confuse potential victims into thinking the letter is from a real agency.

If you believe you are a victim of an IRS impersonation scam, you should report it to the Treasury Inspector General for Tax Administration at its IRS Impersonation Scam Reporting site and to the IRS by emailing phishing@irs.gov with the subject line “IRS Impersonation Scam.”

Keep your personal information safe by remaining alert – and when in doubt, assume it’s a scam. Contact CorpCo with any questions by email or call us at 800-318-7407.