LLC

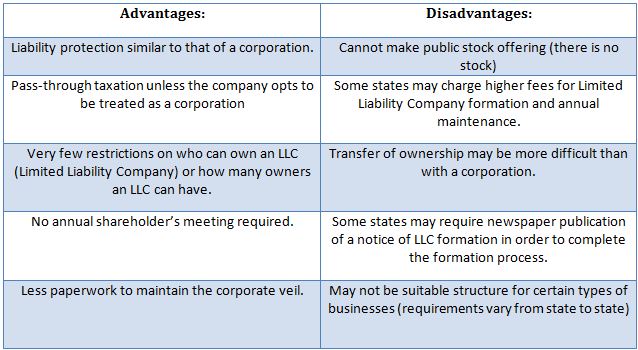

LLCs (limited liability companies) have become very popular over the years. This is due, in part, to a combination of advantages in ownership. Firstly, LLCs provide the liability protection of a corporation, along with the tax benefits of a partnership classification. Secondly, LLCs do not have authorized stock. Therefore, the stock restrictions for ownership (as there are with “S” corporations) do not exist with an LLC. Consequently, the LLC has greater flexibility than the S Corporation in accommodating various forms of ownership, including trusts, corporations and non-resident aliens.

It is necessary to file Articles of Organization (or Certificate of Organization) with the state filing agency in order to form an LLC. The Articles of Organization will require basic information about the company, including:

- Proposed company name

- Registered agent name and address

- Business purpose

Some states may also require the names and addresses of members and/or managers.

If you’re not sure where to begin, it can be a little overwhelming. That’s where we come in.

CorpCo® takes care of the preparation and filing of this document and can provide registered agent services in all 50 US States as well as the District of Columbia. We also offer a variety of other services that may be included in your order such as good standing, certified copy, or EIN (tax ID) obtainment.

If you have questions before ordering, please feel free to contact us. One of our friendly representatives will be happy to assist you.

Ready to form your Limited Liability Company?

Frequently Asked Questions

How many people are needed to form an LLC?

An LLC must have a minimum of one member. There is nothing specifying a maximum number of members.

What is a Limited Liability Company (LLC)?

A Limited Liability Company (LLC) is a type of business structure which has characteristics of both a sole-proprietorship and a corporation. LLCs are able to be treated as a partnership or sole-proprietorship for taxation purposes while offering the personal liability protection of similar to that of a corporation.

Owners of an LLC are called members. Most states do not restrict ownership, and so members may include individuals, corporations, other LLCs and foreign entities. There is no maximum number of members. Most states also permit “single-member” LLCs, those having only one owner.

A few types of businesses generally cannot be LLCs, such as banks and insurance companies. Check your state’s requirements and the federal tax regulations for further information. There are special rules for foreign LLCs.

What is the difference between a member and a manager?

In an LLC, the member is the owner of the company (like the shareholder of a corporation). The member has contributed to the company and has a vested interest. The manager of an LLC is someone who has been appointed by the members to handle the affairs of the business (similar to the director of a corporation). The manager may, but is not required to be a member.

Who can be the member of an LLC?

Typically, there are no restrictions regarding membership of an LLC. A member can be a corporation or other business entity. It is not necessary for the business entity to be a US business. Of course, the member can also be a natural person. If the member is a natural person, some states require that the person be 18 years or older. There is no requirement for a member who is a natural person to be a US resident or citizen.

What happens when I order an LLC formation from CorpCo

You will receive confirmation of your order by email. At the same time, CorpCo will receive and review your request for accuracy and will begin preparing the necessary paperwork. CorpCo will draft your formation document and, in many cases, will act as the organizer. The filing is then submitted to the state for processing. If your order includes Express Processing, it will take priority over other routine requests which means a faster processing time. While turnaround times vary greatly from state to state, routine processing is generally about 7-10 days. With CorpCo’s Express Processing, orders can be completed in as little as 24-48 hours. Once your company has been approved by the state, CorpCo will send confirmation of filing which usually includes a file-stamped copy of the filing and an instrument of organization. If your company formation package includes a corporate kit, CorpCo will ship the kit under separate cover within 3-5 days of company formation.

What is required to keep my company active?

Each state has varying requirements for keeping the company active/in good standing. Most will require some sort of annual filing which may require company details and usually involve a filing fee. In some states, failure to file an annual tax return may also result in the company becoming inactive (not in good standing).