Nonprofit (Not-for-Profit) Corporation

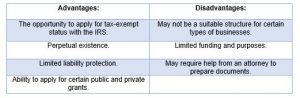

Nonprofit (or not-for-profit) corporations are most commonly used for charitable purposes. Moreover, neighborhood associations, property management, clubs, and other foundations may also choose this structure.

Nonprofit (or not-for-profit) corporations are most commonly used for charitable purposes. Moreover, neighborhood associations, property management, clubs, and other foundations may also choose this structure.

It is most common for a nonprofit to apply for 501(c) tax-exempt status with the Internal Revenue Service (IRS). To apply for tax-exempt status such as 501(c), a nonprofit corporation must meet specific requirements and must be exclusively used for charitable purposes.

By filing for 501(c)status, nonprofit corporations can take full advantage of:

- Credibility – Potential donors may be more inclined to give to an organization that has an official nonprofit status

- Tax-deductible contributions/donations – Individuals making monetary and other donations to the non-profit corporation will be able to take a deduction for the donations on their tax returns. This benefit enhances the desirability to donate.

- Reduced postage rates and other discounted fees.

By forming a nonprofit corporation, you’ll ensure limited liability for the individuals involved in its management. Incorporating a nonprofit association can help establish legal liability protection separating personal assets from the activities of the corporation.

While CorpCo® does handle the incorporation process, we do not handle the processing of the 501(c) paperwork. However, we can refer you to our affiliates upon request. We recommend that you speak with an accountant or attorney before submitting the incorporation order form, to ensure your business is best suited for this type of filing. Contact our office for further information.

Frequently Asked Questions

I want to file for tax-exempt status. What makes this type of filing different?

In order to file for tax-exempt status with the IRS, your non-profit incorporation documents must reflect the details required by the IRS. These details include, but may not be limited to a specific business purpose which indicates that the company is exclusively organized for charitable purposes and an indication as to how the assets of the company will be distributed upon its dissolution.

What happens when I order a non-profit corporation formation from CorpCo?

You will receive confirmation of your order by email. At the same time, CorpCo will receive and review your request for accuracy and will begin preparing the necessary paperwork. If you are applying for 501(c)3 status with the IRS, we will require further information and will contact you to request those details. CorpCo will draft your formation document and send to you for review and the signature of the person to act as incorporator. The filing is then submitted to the state for processing. If your order includes Express Processing, it will take priority over other routine requests which means a faster processing time. While turnaround times vary greatly from state to state, routine processing is generally about 7-10 days. With CorpCo’s Express Processing, orders can be completed in as little as 24-48 hours in many states. Once your company has been approved by the state, CorpCo will send confirmation of filing which usually includes a file-stamped copy of the filing. If your company formation package includes a corporate kit, CorpCo will ship the kit under separate cover within 3-5 days of company formation.

What is required to keep my company active?

Each state has varying requirements for keeping the company active/in good standing. Most will require some sort of annual filing which may require company details and usually involve a filing fee. In some states, failure to file an annual tax return may also result in the company becoming inactive (not in good standing).